Fine Gael is dedicated to delivering homes and building vibrant, resilient communities across Ireland because we believe that every person deserves a secure and affordable place to live. Housing is at the heart of strong communities and economic growth, providing stability for families, young people, and older citizens alike. We are committed to tackling housing shortages, reducing barriers to homeownership, and ensuring that rental options are fair and sustainable.

Fine Gael is dedicated to increasing the supply of homes, from identifying suitable land and streamlining planning to investing in construction methods and workforce growth.

Our focus

Through the National Planning Framework, we aim to balance growth by targeting 50% of new homes in the five major cities—Limerick, Galway, Waterford, Cork, and Dublin—and 50% in the rest of the country. To achieve this, we’ll ensure there’s enough zoned, serviced land in the right places, speed up planning, and embrace modern construction methods to build more efficiently while growing the construction workforce

Fine Gael’s goal is to create communities that are well-connected, with accessible amenities like schools, healthcare, public transport, and green spaces. We aim to develop areas where people can thrive, feel secure, and connect with their neighbours.

To achieve this, Fine Gael is investing in infrastructure and reforming planning processes to speed up delivery. We are committed to helping first-time buyers, supporting affordable rental schemes, and enabling local authorities and developers to work together effectively. Fine Gael will continue working to make Ireland a place where everyone can find a home in a community that supports a fulfilling, high-quality life.

Building more and building faster

Fine Gael led the revival of homebuilding after the financial crisis, tripling housing output between 2011 and 2020 under the ‘Rebuilding Ireland’ initiative, and we have continued this progress with ‘Housing for All’ since 2021.

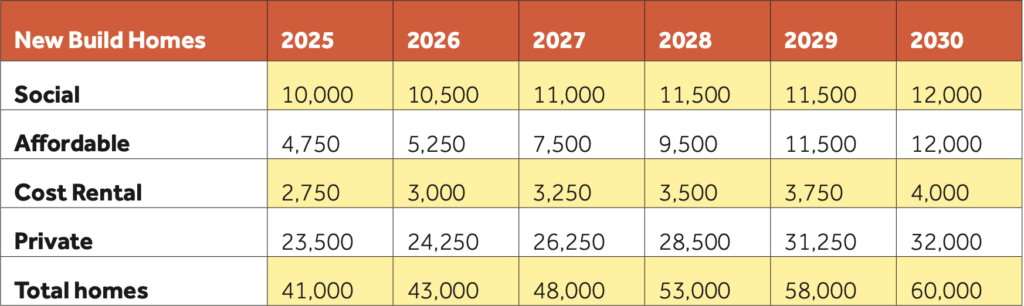

We know Ireland needs more homes, and we need them faster. Fine Gael is committed to delivering 300,000 new homes over the next six years, with a target of 60,000 per year by 2030.

Fine Gael is committed to building homes, supporting communities, and ensuring that every part of Ireland has the housing it needs to thrive.

Fine Gael will

Accelerating Housing Delivery

Fine Gael will

Helping People Buy a Home

Through key initiatives like the Help to Buy Scheme, affordable home schemes, and streamlining the home- buying process, we are dedicated to supporting individuals and families in purchasing their own homes.

Fine Gael will

Expanding Social Housing and Tackling Homelessness

Fine Gael is committed to increasing social housing supply, preventing homelessness, and ensuring Ireland’s housing system meets the needs of all citizens.

Fine Gael will

Supporting a Better System for Renters and Landlords

Fine Gael is committed to a fair and stable rental market that supports both renters and landlords, ensuring long-term housing security and affordability.

Practical Housing Options for all

Fine Gael is committed to appropriate housing for students, older people, members of the Traveller community and frontline workers, providing suitable purpose-built housing options for different needs.

Fine Gael will

Addressing Legacy Issues in Housing

Fine Gael is committed to supporting homeowners affected by construction issues and improving building standards for future developments.

Fine Gael Timeline

2011 – 6,994 homes built nationally. This includes 1,289 social homes built by local authorities and Approved Housing Bodies.

2013 – Successfully renegotiated the EU-IMF bailout, restoring financial sovereignty and strengthening Ireland’s fiscal future.

2013 – Mica in defective concrete blocks emerges as an issue in walls of Donegal homes. Thousands of homeowners are affected, with the cost of remediation expected to reach €2.2bn.

2013 – Fine Gael establish the Pyrite Resolution Board. Some 2,750 affected buildings in Dubin, Mayo, Sligo and Clare constructed between 1997 and 2013 are affected with major defects. Some €192m has been spent on remediation to date.

2015 – In Budget 2015, Fine Gael restore the social housing budget to €2.2bn over three years.

2016 – Fine Gael introduce Rent Pressure Zones, limiting annual rent increases to no more than 2%. Fine Gael publish ‘Rebuilding Ireland’ containing ambitious housing targets.

2016 – 9,791 new homes built, including 669 social homes.

2017 – The Help to Buy Scheme is launched, providing a tax refund of up to €20,000 for use as a deposit.

2017 – Fine Gael launch the Repair and Lease Scheme, aimed at bringing vacant properties in need of repair back into use for social housing. This scheme evolved into the Vacant Property Refurbishment Grant.

2017 – 256 unfinished ghost estates remain to be resolved, with 678 homes built but empty and another 3,608 at various stages of construction.

2017 – 14,281 new homes built, including 2,297 social homes.

2018 – Fine Gael establishes the Land Development Agency to build homes on publicly-owned land.

2018 – The Serviced Sites Fund & Local Infrastructure Housing Activation Fund are established to help pay for water, power and other utilities on sites earmarked for housing.

2018 – The Rebuilding Ireland Home Loan (now the Local Authority Home Loan) is launched, providing a State- backed mortgage for credit-worthy borrowers unable to get a housing loan from the private market.

2018 – The Urban Regeneration and Development Fund is established to part-fund regeneration and rejuvenation projects in our cities and large towns. To date, €1.8bn has been allocated.

2019 – Fine Gael turn the sod on the country’s first cost rental scheme on the Enniskerry Road in Dublin. An ‘Affordable Rental Scheme’ was in the 2016 Programme for Government.

2019 – Fine Gael establish Home Building Finance Ireland (HBFI) to provide finance to homebuilders for rental, social and private homes. To date, funding for almost 8,500 homes has been provided.

2019 – 21,000 homes built, a three-fold increase on the 7,000 constructed in 2011.

2021 – Fine Gael introduce a 10% stamp duty to avoid bulk purchasing of multiple homes in developments.

2021 – Fine Gael establish the National Apprenticeship Office. More than 7,500 craft training places are currently available.

2021 – The Working Group to Examine Defects in Housing is established. It finds fire safety and other construction issues in up 100,000 apartments and duplexes built between 1991 and 2013. The full cost of remediation is estimated at €1.5 – €2.5bn.

2023 – In Budget 2023, Fine Gael introduce the Rent Tax Credit to support renters with the cost of accommodation.

2023 – 32,695 homes built, including 8,110 social homes.